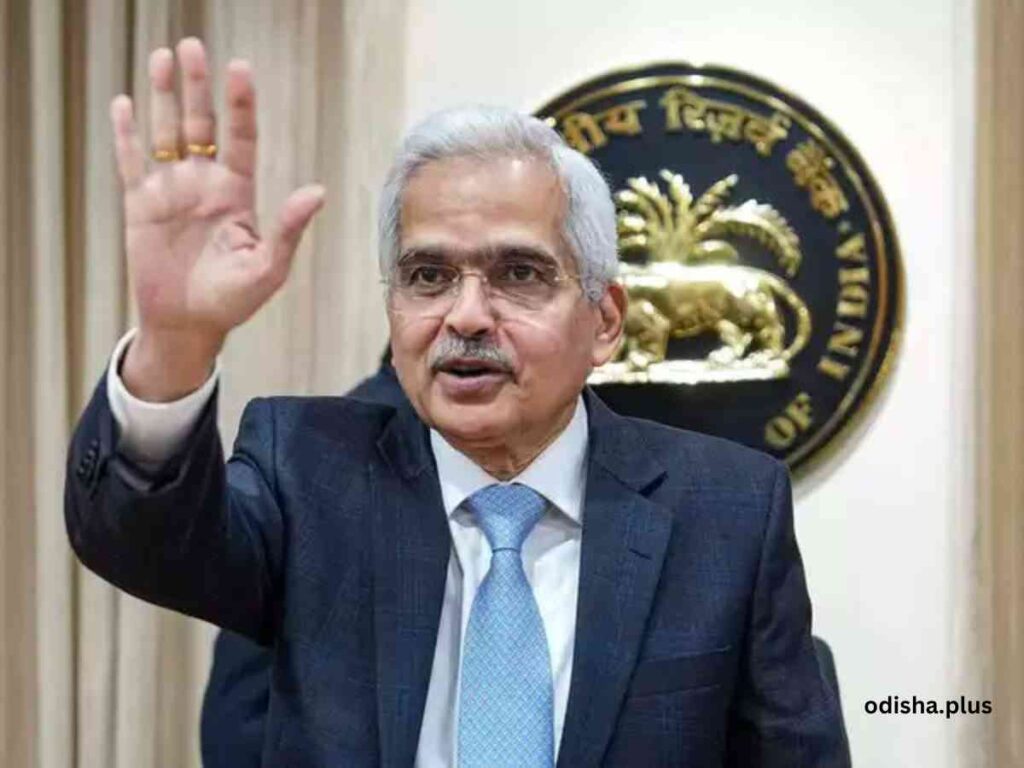

Shaktikanta Das had a challenging tenure

OdishaPlus Bureau

Shaktikanta Das took over as RBI Governor in December 2018 after Urjit Patel had quit unexpectedly, citing personal reasons. Das has had a challenging tenure. In his six years as governor — he was granted an extension in 2021 — Das deftly navigated a difficult domestic and global environment. He led the central bank through a pandemic, the Russia-Ukraine war, and the conflict in Gaza, while also leading it into newer areas such as digital currency.

All the while, he ensured that relations between Mint Street and North Block were harmonious. When he took over as governor, Das had to deal with the NBFC crisis, following the collapse of IL&FS and Dewan Housing. However, the biggest challenge that the central bank had to face was the Covid pandemic.

Under his leadership, the RBI acted quickly, loosening policy rates, and also announcing a series of measures to help cushion the economy from the consequences of the pandemic. Das presided over a dramatic decline in bad loans of the banking system — gross non-performing assets have fallen to 2.8 percent of advances as of March 2024, down from 10.8 percent in September 2018.

On inflation management, the record of the central bank has been more mixed. It has been argued that the RBI had underestimated the price pressures in the economy following the recovery from the pandemic. As a consequence, it was slow to raise interest rates. These fears proved to be justified when inflation breached the upper threshold of the central bank’s inflation-targeting framework for three consecutive quarters.

There are similar concerns now that the central bank is more worried about inflation and less about growth, which is leading it to keep policy rates more restrictive than what is needed. On currency management as well, the central bank has been more interventionist, in 2022 and now. The pace at which its forex reserves have depleted indicates to some extent its interventions in the currency market.

Sanjay Malhotra, currently serving as the revenue secretary, is poised to take over the role of Governor of the Reserve Bank of India (RBI), succeeding the outgoing governor, Shaktikanta Das. This transition reflects a strategic decision by the government, which seems to believe that a bureaucratic approach may yield better results in managing the intricate relationship between the RBI and the finance ministry.

The rationale behind this perspective is that a bureaucrat, with a deep understanding of governmental processes and policies, might be more adept at aligning the central bank’s objectives with the broader economic goals set by the government, as opposed to an independent economist who may prioritize monetary policy autonomy. Malhotra steps into this pivotal position at a critical juncture for the Indian economy.

There is mounting pressure on the RBI to consider lowering policy interest rates, a move that many stakeholders believe is essential to stimulate economic growth. The current economic landscape is characterized by a mix of challenges, including sluggish demand, inflationary pressures, and the need for robust recovery post-pandemic.

#ShaktikantaDas #RBI #RBIGovernor #ReserveBankOfIndia #InflationManagement #MonetaryPolicy #EconomicChallenges #IndiaEconomy #FinancialStability #SanjayMalhotra #GovernorLegacy