The Union Budget 2025-26 aims to harmonize India’s economic stability with advancements in social and infrastructural sectors

Dr Navya Gubbi Sateeshchandra & Dr Samrat Ray

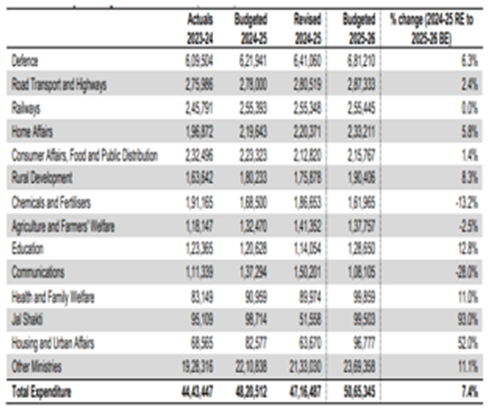

Concerning the Indian Union Budget for 2025 to 2026, a strategic approach aims to be initiated for fiscal consolidation while fostering improvement across different industries. In the same period, the forecasted estimation has been determined to be INR 50.65 trillion (Rs. 50.65 lakh crore) which further shows a rise of 7.4% compared to the revised forecasts of 2024 to 2025.

This particular budget is set to effectively align the economic stability of India with the social and infrastructural sector developments. Furthermore, the budget shows the dedication of the government to decreasing outstanding liabilities and fiscal deficits while emphasizing policy improvements, infrastructure developments, and tax reforms.

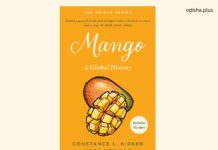

The government of India has estimated a 10% nominal GDP growth rate for the year 2025-26, thereby aligning and amalgamating the inflationary anticipations with real economic expansion. It is expected that the fiscal deficit is determined to decline from 4.8% of GDP in 2024-25 to 4.4% of GDP in 2025-26. Therefore, it depicts a slow and restrained strategy for deficit control. Moreover, in 2025-26, the revenue deficit is projected to decline to 1.5% of GDP as compared to 1.9% of GDP in 2024-25.

Figure 1: Fiscal Deficit and Revenue Deficit: Actual vs Budgeted

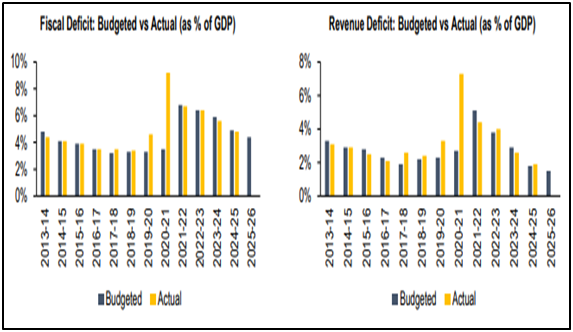

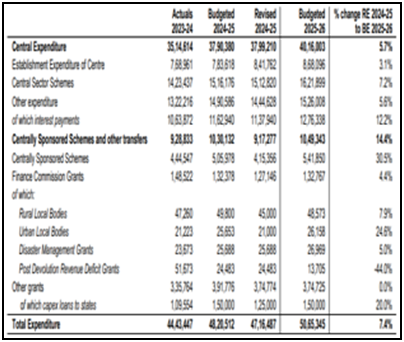

The overall forecasted expenditure for the period of 2025 to 2026 aims to be at INR 506.53 trillion (Rs. 506.53 lakh crore) which is considered 7.4% more as compared to the revised forecasts of the earlier fiscal year – 2024-25. Interest payments show 37% of revenue receipts and 25% of overall expenditure. At the front of the receipts, non-borrowing revenues are estimated to be at INR 34.96 trillion (Rs. 34.96 lakh crore) thereby showing a rise of 11.1% from the period 2024-25. The key focus of the Indian government on raising the tax revenue by 11% highlights the goal of meeting fiscal sustainability.

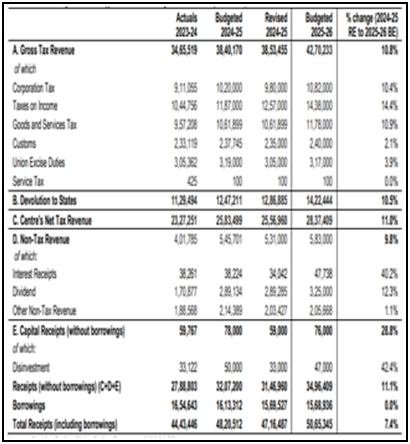

Table 1: Glance of the Indian Budget of 2025-26 in (Rs. Crore)

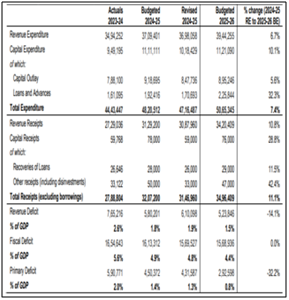

By the end of 2031, the government will focus on reducing its outstanding liabilities to 50% of GDP where the debt-to-GDP ratio for the period 2025-26 is forecasted to be at 56.1%. Thus, this outlines a long-term strategy to decrease the national debt and at the same time, assuring capital investments in major industries.

Figure 2: Outstanding Liabilities and Interest Payment of Revenue Receipts

The deadline to record the updated returns has been raised from 2 to 4 years where the penalties are 60% and 70%, respectively. Therefore, this shift is anticipated to restrict tax evasion and improve tax compliance.

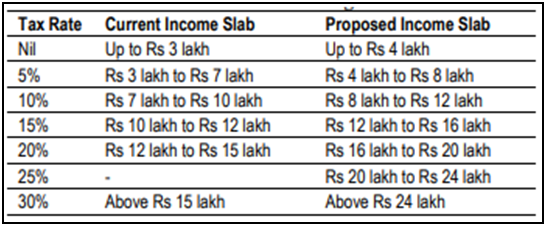

Table 2: Tax Slabs under New Tax Regimes

Based on the alterations in the tax slabs, the new income regime has been modified. Earning an income up to INR 1.2 million (Rs. 12 lakh) can now get a rebate of 100% on taxable income, an increase from the previous threshold of INR 0.7 (Rs. 7 lakh) million. It is stated that the earlier tax regime stays static.

On particular items like motor vehicles and solar cells, the customs duty has been decreased. However, at the same time, an AIDC – Agriculture Infrastructure and Development Cess has been initiated. Therefore, this shift assures that the total tax accumulation stays unchanged while leading sponsorships or funds toward agricultural advancement.

The TCS limits on remittances have been raised to INR 1 million whereas the threshold for TDS on rent has been similarly raised to INR 0.6 million (Rs. 6 lakh). Moreover, no TCS shall be imposed on remittances especially academic or education loans obtained from particular banks or financial institutions.

To enhance access to credit, a credit guarantee cover shall be increased to a double level for start-up companies and MSMEs – Micro, Small, and Medium Enterprises. Furthermore, the essential rise has been seen in the turnover and investment limits for MSMEs.

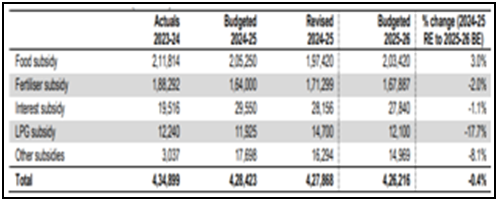

Table 3: Subsidies in 2025-26 in (Rs. Crore)

Concerning the reviewing of the regulations, permissions, licenses, and certifications associated with the non-financial sector, proficient experts shall be appointed. In addition, the Financial Stability and Development Council shall develop a framework to evaluate the effects of financial regulations and generate structure for the development of the industry. Moreover, the introduction can be further seen in an Investment Friendliness Index of states.

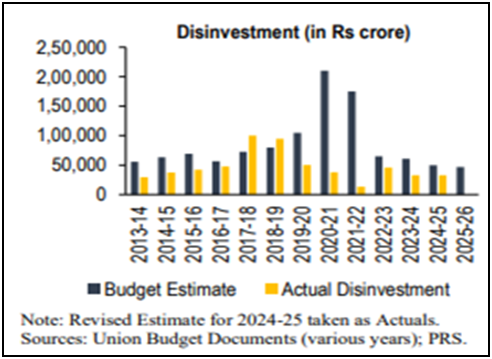

Figure 3: Disinvestment Targets

All of the infrastructure ministry shall develop a 3-year project portfolio, especially to collaborate between the private and public sectors. Additionally, a 2nd asset monetization plan shall further be introduced for 2025-30. Moreover, the National Geospatial Mission shall be modified further related to urban planning and land records. Furthermore, the upgraded UDAN scheme as a connectivity strategy focuses on enhancing air travel to 120 new locations or destinations.

Table 4: Ministry-Wise Expenditure in 2025-26 in (Rs. Crore)

It has been noticed that to drive foreign or international investment, the limit of the FDI for the insurance industry has been increased from 74%-100% for organizations spending their overall premium in India. Additionally, a new income tax bill shall further be set to simplify the taxation standards and policies.

The Indian government has further notified about a fund such as the Urban Challenge Fund of INR 0.1 million (Rs. 1 lakh) to support developing cities. Also, INR 150 billion (Rs. 15,000 crores) has been assigned to build 0.1 million (1 lakh) housing units, especially in stressed projects.

Relying on the electricity distribution reforms, an increase in borrowing by 0.5% of GSDP can be permitted to the states of India. Additionally, adjustments to the Civil Liability for Nuclear Damage Act and Atomic Energy Act shall further allow private industry to collaborate in nuclear energy where a new Nuclear Energy Mission shall be developed to get an expenditure of INR 20 million (Rs. 2 crore).

An initiative has been introduced for a 6-year mission to meet self-dependence in pulses. Eventually, Prime Minister Dhan-Dhaanya Krishi Yojana aims at improving crop diversification and productivity in all over 100 low-yielded districts. Furthermore, concerning the Modified Interest Subvention Scheme’s loan limit, it has been raised to INR 0.5 million (Rs. 5 lakh) for the farmers who are particularly leveraging the Kisan Credit Card.

An extra 10,000 seats aim to be granted in hospitals and medical universities in 2026 and in the upcoming 5 years, a total of 75,000 seats shall be created further. Additionally, concerning technological research and study, 10,000 PM Research Fellowships shall be provided. Also, at IITs, the infrastructure further focuses on being enhanced and expanded.

As per the Ayushman Bharat, gig employees shall have the opportunity to healthcare access, whereas the street vendors shall be offered UPI-linked credit cards worth INR 30,000 (Rs. 30,000) after the modification of the PM SVANidhi Scheme. Furthermore, a new scheme shall navigate socio-economic developments for urban employees.

In 2025-2026, by excluding the borrowings, the receipts are projected at INR 34.96 trillion (Rs. 34,96,409 crore) which is considered a rise of 11.1% as compared to 2024-25. Furthermore, it is anticipated that the gross tax revenue aims to increase by 10.8% thereby outperforming 10.1% GDP growth. Additionally, the income and corporate tax revenues are projected to rise by 14.4% and 10.4%, respectively whereas on the other hand, the GST revenue is forecasted to increase by 10.9%.

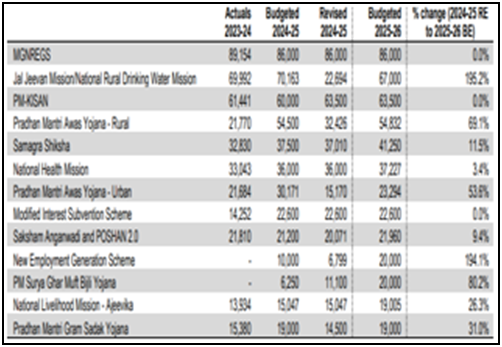

Table 5: Scheme Wise Allocation in 2025-26 in (Rs. Crore)

The capital expenditure of India is expected to reach 10.1% whereas the revenue expenditure is forecasted to increase by 6.7%. However, PM-KISAN and MGNREGS are the key schemes where the allocation still remains stable. In 2025-26, the disinvestment targets shall be INR 470 billion (Rs. 47,000 crore) thereby indicating a decline from 2024-25’s target such as INR 500 billion (Rs. 50,000).

Table 6: Segregated Categories of the Central Government Receipts in 2025-26 in (Rs. Crore)

INR 25.59 trillion (Rs. 25,59,764 crore) shall be transferred by the Indian central government in 2025-26 to states thereby presenting a rise of 12.5%. Therefore, this encompasses INR 11.37 trillion (Rs. 11,37,320 crore) in grants and INR 14.22 trillion (Rs. 14,22,444 crore) in tax devolution, whereas the INR 1.5 trillion (Rs. 1,50,000 crore) is assigned associated with capital expenditure loans.

Table 7: Segregated Categories of the Central Government Expenditure in 2025-26 in (Rs. Crore)

The Indian budget for the period 2025-26 focuses on the dedication of the government to uphold fiscal discipline while influencing or stimulating development-centric reforms across different industries. By incorporating an equalized strategy to emphasize industrial development, managing expenditures, and revenue generation, the budget focuses on strengthening the economic foundation of India. Strategic efforts in industry, social welfare, infrastructure, and taxation can not only foster inclusive development but further assure sustainable long-term economic stability. Additionally, the Indian budget shows the commitment of the government bodies to develop a flexible and adaptable economy, thereby guiding major industries and overcoming issues experienced by diverse segments of society.

(Dr Navya is a Professor at Berlin School of Business & Innovation, Berlin, Germany & Dr Samrat is Dean at IIMS, Pune. Views expressed are personal.)